Why do I need a Risk Assessment Policy?

Why do I need a Risk Assessment Policy? Risk Assessment Policies are a great tool to help business define and determine areas of risk or vulnerability, both to their staff and customers. A well-defined policy can help improve workplace safety as well as identify and reduce potential negative impacts of events ranging from natural disasters […]

Buying and Selling a Business – Asset or Equity Sale?

Buying and Selling a Business – Asset or Equity Sale? You’ve decided to either sell your current business or buy a new one. You’ve done a business valuation or appraisal to confirm the value of the business, including its assets, goodwill, and related factors. The next step is to determine the purchase price and how […]

I’ve Decided to Sell My Business- What Do I Do?

I’ve Decided to Sell My Business- What Do I Do? Whether you started it in your garage or bought in at the ground level, you’ve dedicated your time, energy, and talent to creating and growing your business over the last several years. Now, you’re ready to try something new – whether it’s a new business […]

Making Your Charitable Dreams a Reality – Part Two: The Application

Making Your Charitable Dreams a Reality – Part Two: The Application Once you have your nonprofit corporate entity formed, it is time to apply for tax-exempt status. The tax exemption application must be filed within 27 months from the end of the month in which it was formed. There are exceptions to this rule, but […]

Making Your Charitable Dreams a Reality – Part One: Formation

Making Your Charitable Dreams a Reality – Part One: Formation The attorneys at Waldron & Schneider enjoy helping clients make their charitable dreams come true by turning their charitable ideas and passions into an official charitable organization or private foundation. Achieving tax-exempt status requires several steps including: forming a corporate entity, obtaining an employer identification […]

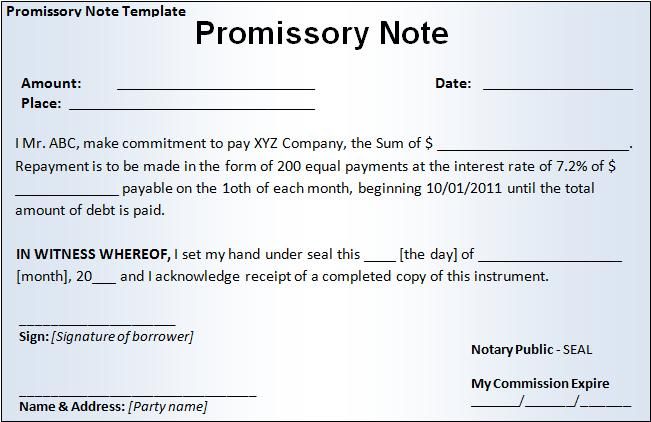

Potential Legal Implications of the Promissory Note

Potential Legal Implications of the Promissory Note The Promissory Note is a valuable tool used by individuals and businesses alike to lend and borrow money outside the parameters of traditional financing through a bank. Promissory Notes are often made for investment purposes but can also be used for personal reasons, to provide financing when funds […]

Proposed Changes to Estate Tax

Proposed Changes to Estate Tax Recent information regarding the proposed tax changes by the Biden Administration includes a proposal to reduce the federal estate and GST tax exemption from $11,700,000 per individual to the 2009 level of $3,500,000 per individual. There is even a proposal to reduce the federal gift tax exemption to $1,000,000 per […]

Wire Fraud or “Business Email Compromise” – is the Bank liable?

Wire Fraud or “Business Email Compromise” – is the Bank liable? Many businesses and individuals rely on wire transfers for various payments and transactions. A wire transfer is an electronic transfer of funds between parties or, more accurately, between the parties’ banks. These types of transfers are privy to wire fraud, which occurs when a […]

Responding to Positive COVID-19 Test Results in the Workplace

Responding to Positive COVID-19 Test Results in the Workplace You’ve taken all available steps to protect your staff and maintain a safe workplace. But, what do you do if your employee reports to work with COVID-19 symptoms or reports a positive test result? Based on the current Center for Disease Control Guidelines for Business and […]

Daycares, Parents, and Court Orders

Written by Waldron & Schneider Attorney Kimberly A. Bartley. As a daycare owner in Texas, when parents are parties to a custody agreement outlining when each parent’s visitation period begins and ends, are you bound by the Court’s Order? The Texas Administrative Code contains the minimum standards acceptable for a daycare’s activities. These including addressing […]